Customer Measurement Problem 3

VIEWING SATISFACTION IN ABSOLUTE TERMS

Jump To Page – Intro, 1, 2, 4, 5, 6, 7, 8, 9, 10, 11, 12, Conclusion

Many organizations view customer measurements in absolute terms. For example, let’s say Company Z uses a survey process to measure customer satisfaction on a 10-point scale. Let’s say Z reports the mean across customers as a key corporate performance metric. For sake of argument, assume the mean value is 7.8 in some given measurement period. Is that good? Is that bad? If 10 is “very satisfied” and 1 is “very dissatisfied,” at least we have some reference for interpreting the 7.8 number. However, the number in the absolute alone can be quite misleading. If for example we have a single primary competitor who achieves a rating of 9.5, will we still pat ourselves on the back for our 7.8? Not likely. This “high absolute but low relative” scenario makes it clear that there is danger in viewing satisfaction in absolute terms alone.

Many organizations view customer measurements in absolute terms. For example, let’s say Company Z uses a survey process to measure customer satisfaction on a 10-point scale. Let’s say Z reports the mean across customers as a key corporate performance metric. For sake of argument, assume the mean value is 7.8 in some given measurement period. Is that good? Is that bad? If 10 is “very satisfied” and 1 is “very dissatisfied,” at least we have some reference for interpreting the 7.8 number. However, the number in the absolute alone can be quite misleading. If for example we have a single primary competitor who achieves a rating of 9.5, will we still pat ourselves on the back for our 7.8? Not likely. This “high absolute but low relative” scenario makes it clear that there is danger in viewing satisfaction in absolute terms alone.

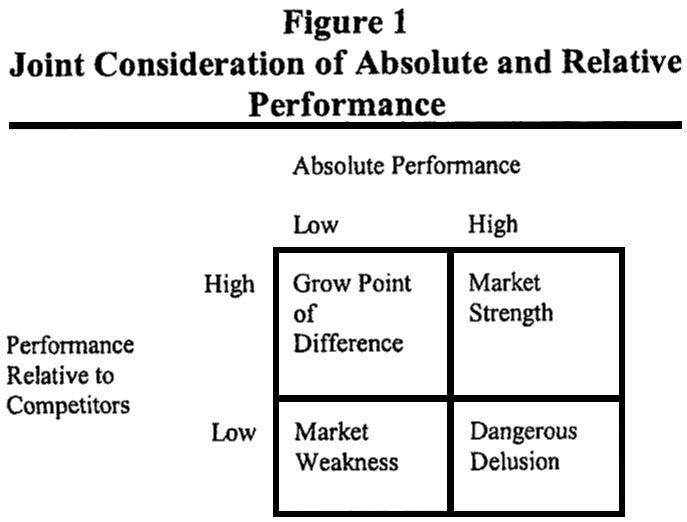

The interpretation of performance should hinge jointly on at least two dimensions: absolute level of performance, and performance relative to competition. For simplicity in our discussion here, let’s consider an example of satisfaction with product quality. Assume this has been measured in both absolute and relative terms. Further, let’s consider each performance dimension dichotomously. Obviously in practice there are more gradations than that, but this simplified view will allow me to make my point. In this dichotomized world, a focus on absolute performance would result only in two types of conclusions. Either we are doing well on product quality, or we are not doing well. However, when we also consider performance relative to the competition, there are four, not two, possible conclusions. These are shown in Figure 1.

The off-diagonal cells reveal the importance of this joint absolute and relative view. First, consider the Low Absolute-High Relative cell. Had we considered absolute performance only, we might have concluded product quality was an area of weakness for the company. Likely, we would not have tried to communicate our capabilities as a strength to the market in our marketing communications. However, now knowing that our performance relative to competition is fairly strong, we might have quite a different take on the absolute figure. Certainly, it is a point for improvement. However, it also is a point of positive competitive differentiation. Strategically, we might want to broaden our lead while simultaneously beginning to leverage the existing gap through marketing communications.

Even more important is the other off diagonal cell – the High Absolute, Low Relative cell. What a dangerous delusion it is for a company to believe that they are performing above board simply because their absolute scores are high. Relative to competition, they are faring poorly. Again, consider the product quality example. The absolute scores might lead the company to feel they are doing very well. Meanwhile, competition is severely beating them on that dimension. And while the company might be tempted to tout product quality in marketing communications as a corporate strength, that tactic would likely erode market credibility. If customers know other companies are far better, while the company is extolling its virtues the likely consequence is to seriously erode brand credibility, and perhaps erode any image of integrity. From a CS/D perspective, marketing communications like that also would be setting an expectation for high levels of performance, which, when the experience is considered relative to competition, ends up negatively disconfirming expectations, thus producing dissatisfaction.

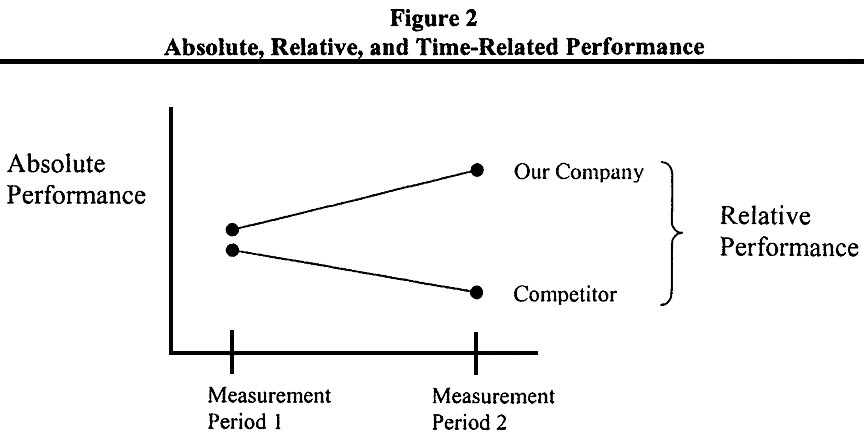

A third dimension could be considered here as well. It is the dimension of time. It too involves a relative perspective. Specifically, how are performance levels improving or declining in comparison to the prior measurement period? The original mean of 7.8 implies one thing if we were at 9.2 the measurement period before. We’ve significantly declined – obviously a bad thing. If however we previously were at 6.5, we might be quite thrilled with the 7.8 performance, particularly  if competitors’ scores had declined across the same time period. Figure 2 shows one possible graphic display that incorporates absolute levels of performance, performance relative to competition, and performance relative to some prior period, all in a single display. Clearly it is not an “absolute only” proposition. Joint consideration of all information in the display will determine how we interpret our current performance.

if competitors’ scores had declined across the same time period. Figure 2 shows one possible graphic display that incorporates absolute levels of performance, performance relative to competition, and performance relative to some prior period, all in a single display. Clearly it is not an “absolute only” proposition. Joint consideration of all information in the display will determine how we interpret our current performance.

The main point here is simple: consideration of absolute measures in isolation, without considering relative competitive and perhaps time-based performance, can be quite misleading and problematic.